Global Insurance Fraud Detection Market study includes In-depth Analysis of the market by latest technologies, trends, opportunities, challenges, key players and business strategies considering types, segment, and future analysis. The Insurance fraud detection Market Report Provides Growth History, Sales Channel, Manufacturers Profiled in Insurance fraud detection Business, Market Share of Product, Application and Regional Scope of Insurance fraud detection which makes the research report a helpful resource for marketing people, forecasters, industry executives & consultants, sales, product managers, Strategy Advisor, potential investors to understand the present as well as future market size, situations in terms of growth rate and revenue. This report will help the viewer in Better Decision Making.

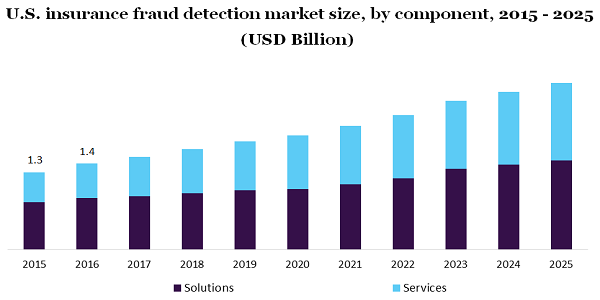

The global insurance fraud detection market size is estimated to account for USD 9.7 billion by 2025. The market is projected to grow at 13.7% CAGR as per Million Insights. Over the past few years, insurance fraud has emerged as a huge challenge for insurers. The rise in the number of fraudulent claims has resulted in a growing focus on the deployment of advance and effective detection solution. The advent of advance tools such as image screening, predictive analytics, self-learning models and text mining among others have immensely improved the insurance claim services and reduced the occurrence of fraudulent activities.

Download Free Sample Report Now @ https://www.millioninsights.com/industry-reports/global-insurance-fraud-detection-market/request-sample

Claimants have been using sophisticated methods to defraud the insurers. This has led to coherent action by leading insurance providers companies against perpetrators. As estimated by FBI, the insurance companies suffer over USD 40 billion in losses due to defraud in an insurance claim in the United States. In addition, this has resulted in increased premium by USD 420 to 700 in a year per family in the country. Similarly, the Association of British Insurers has found over 113,000 fraudulent claims costing millions of dollars each year. Therefore, rise in the number of fraudulent activities has forced the governments to introduce stringent regulatory guidelines. The imposition of stringent regulatory measures are further estimated to drive the demand for the fraud detection system.

North America accounted for the highest share in the insurance fraud detection market in 2018 and the region would maintain its dominance in all likelihood. The presence of the number of solution providers in the region is driving regional growth. Asia Pacific is likely to register the highest growth rate over the forecast years owing to increasing awareness about reducing the fraudulent activities.

Table of Contents

Chapter 1 Insurance fraud detection Market Overview

1.1 Insurance fraud detection Definition

1.2 Insurance fraud detection Market Size Status and Outlook (2019-2025)

1.3 Global Insurance fraud detection Market Size Comparison by Region (2019-2025)

1.4 Global Insurance fraud detection Market Size Comparison by Type (2019-2025)

1.5 Global Insurance fraud detection Market Size Comparison by Application (2019-2025)

1.6 Global Insurance fraud detection Market Size Comparison by Sales Channel (2019-2025)

1.7 Insurance fraud detection Market Dynamics

1.7.1 Market Drivers/Opportunities

1.7.2 Market Challenges/Risks

1.7.3 Market News (Mergers/Acquisitions/ Expansion)

Chapter 2 Insurance fraud detection Market Segment Analysis by Player

Chapter 3 Insurance fraud detection Market Segment Analysis by Type

And Continue…

Know More Insights @ https://latestmarketstudy.wordpress.com

No comments:

Post a Comment