The global alternative lending market size is estimated to reach USD 807.8 billion by 2028 according to a new report by Million Insights. The market is expected to expand at a CAGR of 5.3% from 2021 to 2028. The minimum interest rate is the key factor that drives the growth of the market. In addition, the upsurge of innovative operating models is also acting as the driver for the market. The development of small and medium-sized enterprises, particularly in emerging countries, is another factor fueling the growth of the market.

However, lack of borrower protection is the major restraint for the market. Most of the key players operating are adopting different strategies such as mergers and acquisitions to capture maximum market share globally. In addition, almost all players working in the market are actively looking to diversify sources of financing. The COVID-19 pandemic has positively impacted the market. The business has witnessed steady growth due to the COVID-19 pandemic as most of the sectors suffered huge revenue losses and their request for loans increased largely to recover from these losses.

Download Free Sample Report Now @ https://www.millioninsights.com/snapshots/alternative-lending-market-report/request-demo

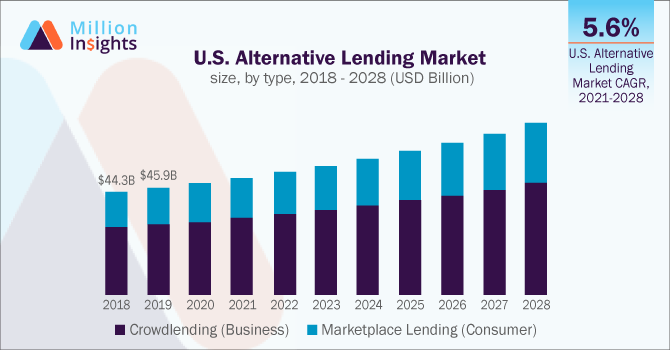

Moreover, the consumer request for personal loans and educational loans also increased due to the impact of the COVID-19 pandemic. Thus, the COVID-19 pandemic has played an important role in pushing the development of the market. The crowdlending (business) segment contributed to the global market revenue share of more than 65% in 2020. Crowdlending provides private individuals, SMEs, and self-employed people an interesting alternative to a traditional bank loan, allowing them to get finance in a straightforward way and in reasonable conditions.

Alternative Lending Market Report Highlights

• In North America, the market is expected to forecast to the highest CAGR of 5.7% from 2021 to 2028. Alternative lenders are mainly concentrating on SMEs and education loans are the important sources of external financing for small businesses and is vital to helping them continue cash flow, buying new inventory or equipment, and raise their business

• In Asia Pacific, the market is expected to accounted for the largest revenue share in 2020 owing to digitization and supportive initiatives by governments to promote alternative lending in the region

• The market place lending (consumer) segment is likely to register the highest CAGR of 5.5% from 2021 to 2028. Market place lending is a rapidly developing and evolving industry including new organizations and technologies, individual borrowers and savers, and institutional investors

Most of the borrowers are seeking such type of lending platform to get instant loans for their requirements. Thus, the demand for crowdlending (business) is high and contributes more to the market revenue. Asia Pacific accounted for the largest market share of over 80% in 2020. In 2020, China was the major country for the market globally. An increase in digitization initiatives among financial institutions and a surge in government initiatives for alternative lending in developing countries, such as India and China are the important factor for large revenue generation. In addition to that, a large number of small and medium enterprises are working in Asia Pacific have given rise to market.

Know More Insights @ https://millioninsightsdatabase.wordpress.com

No comments:

Post a Comment