The global robo-advisors market size is estimated to reach USD 5,401.19 billion by 2028, registering a CAGR of 18.6% over the forecast period, according to a new report by Million Insights. The cost-effective investment advisory and more accessibility is the key driver for the market. In addition, the augmented use of technology by advisors for advice and execution drives the industry growth. However, the lack of investment choice is the major restraint for the market. The COVID-19 pandemic had a positive impact on the market.

The industry had witnessed considerable growth due to the increased adoption of robo advisors for efficient wealth and asset management in a large volatile market during the pandemic. Most of the investors took benefit of investment opportunities that occurred during the pandemic. The competencies of robo advisors to reduce illogical behavior and poor & spontaneous decision-making during a critical time like the COVID-19 pandemic remarkably contributes to the market development.

Download Free Sample Report Now @ https://www.millioninsights.com/snapshots/robo-advisors-market-report/request-demo

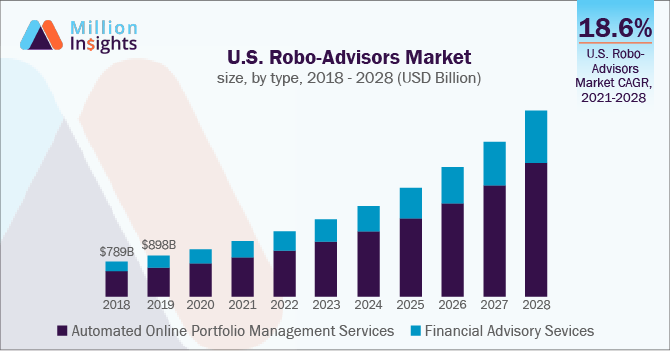

The automated online portfolio management services segment accounted for the maximum revenue share in 2020. The automated online portfolio management services help customers with an investment strategy that has the potential to grow. Moreover, these services help the customers reach their goals with a diversified portfolio that stays aligned with their preferred risk tolerance. Thus, its demand is high and contributes more to the market revenue.

Robo-Advisors Market Report Highlights

• Asia Pacific is estimated to grow at the highest CAGR from 2021 to 2028 due to a rise in internet usage along with low-cost investment guidance, as well as growth in digital consulting technologies’ maturity

• North America accounted for the largest market share in 2020. The U.S. majorly contributes to the North America regional market

• The U.S. was the first country to introduce the automated financial advisor and also represent the leading robo-advisory industry in the world

• The rise in the adoption of robot advisory among investors is also acting as a reason for the growing demand for this technology. The highest asset under management in the market was reached in the U.S. in 2020

• The financial advisory services segment is likely to register the highest CAGR from 2021 to 2028

• FinTech companies depend on technology advisory by implementing AI and ML to offer precise and transparent services to retail investors, thereby driving the segment growth

Know More Insights @ https://millioninsightsdatabase.wordpress.com

No comments:

Post a Comment